Avery Cook, Caitlin Kleinfelter

eSomethin’ Staff

As the senior class’ graduation date draws closer, students all over the country begin to consider where they will continue their higher education, if at all. Another aspect that worries students is how they will pay for college if they decide to go.

According to Forbes, the total student loan debt in the country is around $1.56 trillion USD, making it seemingly impossible for individual students to pay for college without graduating with hundreds of thousands of dollars in debt. Deciding if they are financially able to pay off thousands of dollars in debt is a big decision for a young adult to make, especially when emotions and stakes are high.

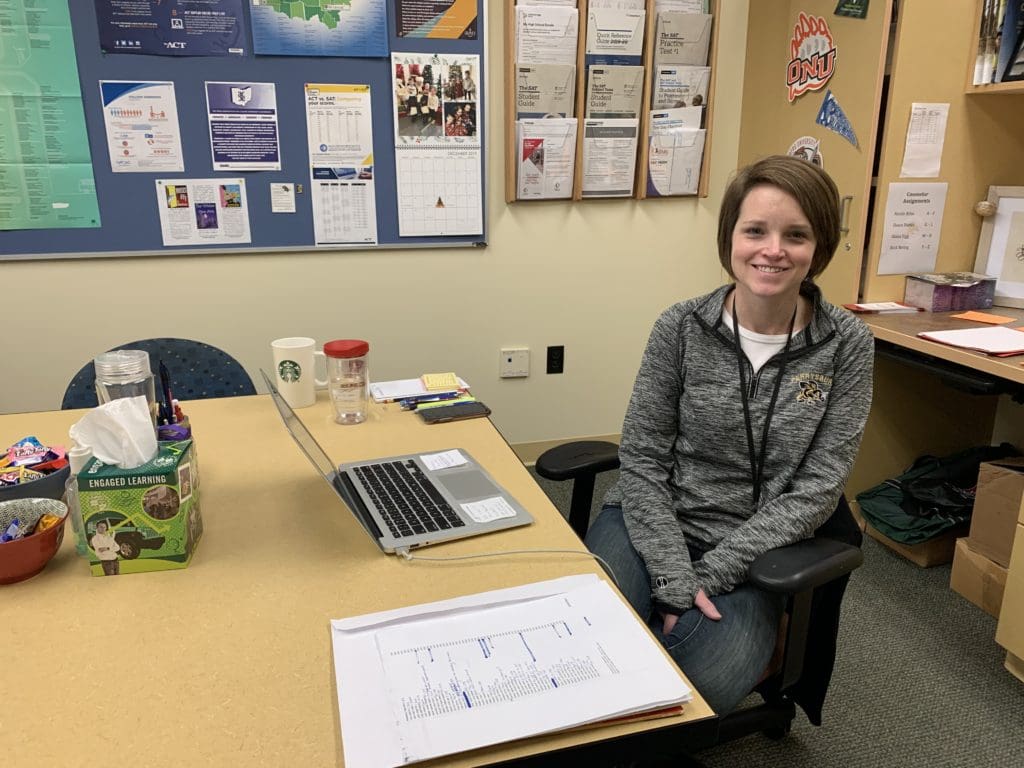

Here to help is Perrysburg High School’s Director of College Advising Lindsay Czech, whose job is to help students in their college searches and applications.

Czech’s advice for students wanting to go to college but who may struggle with cost is to fill out the FAFSA, the Free Application for Federal Student Aid (fafsa.gov). FAFSA will “…offer [them] grants, which is free money that you do not have to pay back, loans, which you do have to pay back, or make you eligible for federal work study jobs on campus. The government is going to determine how much money you get in order to help you pay for school,” Czech explained.

Additionally, scholarships are offered through Naviance. Czech constantly posts new scholarships and opportunities for students throughout the school year. Currently, there are 18 available scholarship opportunities on Naviance but Czech explained that more will become available in the winter months.

For most prospective college students, scholarships are not enough.

Noah McEachern, a senior, meditates on the conflicts of saving money for college: “When you are from a middle class family, paying for college is a scary thought. You do not qualify for much aid nor have the financial security to get through. For me, I am partially responsible for my undergraduate costs.

”I work every weekend and save my money, knowing it is only going to make a minimal impact on college” McEachern said.

However, it is not only current seniors that are beginning to think about college decisions. In the middle of one of the most important years of high school, current juniors are prepping for the ACT and SAT testing, going on college visits, and beginning to worry about their financial situations and payment plans for tuition.

Junior Kaylee Rose explains some of her concerns: “[I am worried] that the debt will be there forever and that I will not have enough money to ever pay it off.”

Rose continued, “I think I have heard of [FAFSA], but I am not exactly sure what it is.”

It is important that Perrysburg High School has resources to properly educate students on this process, like counselors and advisers like Czech. In addition, Czech hosts the Common App boot camp, college fairs, and arranges for representatives of different colleges to come to the high school to educate students on their college and the application process.

For students who are stressed by the prospects and the process, people like Czech are here to help.

Other stories on eSomethin:

- Perrysburg’s sixth grade camp tradition to cease next school year

- Explore the 2024 Solar Eclipse: History, Safety, How To Experience It

- Celsius energy drink flows through water fountains on April 1st

- Taft is the New Principal of PHS on April 1

- eNothin exclusive: After reviewing security footage on April Fool’s Day, Perrysburg admin discovers Anthony Wayne students took the rivalry too far, resulting in school-cancelling power outage